Both Oregon and Washington offer first-time homebuyer programs that make homeownership more accessible. From down payment assistance and lower interest rates to reduced mortgage insurance, these programs help qualified buyers start strong without the heavy upfront costs. Here’s what you need to know.

What Programs Help First-Time Buyers in Oregon and Washington?

- Oregon programs: OHCS Flex Lending (4% to 5% of loan amount); this can typically cover your full down payment.

- Washington programs: House Key Opportunity, Home Advantage with down payment assistance loans, Veterans Downpayment Assistance.

- Down payment assistance amounts: These range from 3% to 5% or the purchase price, depending on location and program.

- Eligibility requirements: Vary widely. Most programs require income at or below the area median income. Others have income limits as high as $215,000, and some even have no income limit.

- Key benefit: Many programs can cover up to 100% of the cash needed for your down payment.

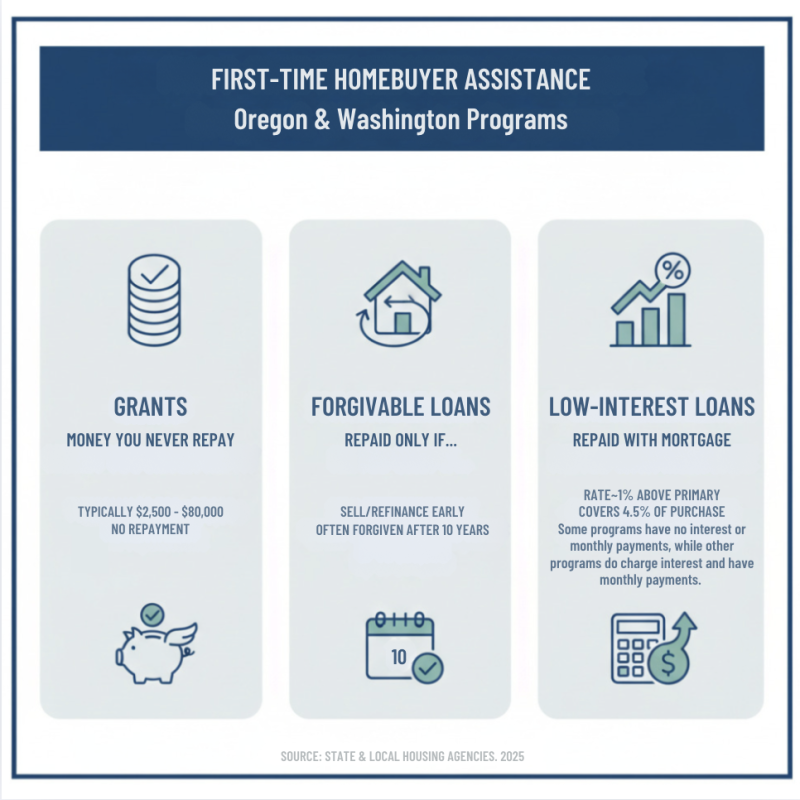

State and local programs in Oregon and Washington provide grants, forgivable loans, and low-interest mortgages to help first-time buyers. For example, Oregon’s OHCS Flex Lending can cover up to 100% of your down payment, while Washington’s House Key Opportunity and Home Advantage offer down payment assistance with no monthly payments. Understanding these options is the key to opening up your homeownership goals.

What Financial Help Is Available? (Grants, DPA, and More)

The biggest challenge for most buyers isn’t the monthly mortgage payment—it’s the cash for the down payment and closing costs. First-time homebuyer programs in Oregon and Washington address this directly with several types of financial aid.

- Down payment assistance (DPA): This is an umbrella term for aid that helps cover your down payment and/or closing costs. Assistance amounts vary from a few thousand dollars to up to $40,000 for some programs.

- Closing cost assistance: This aid specifically targets fees like appraisals, title insurance, and loan origination charges, which can add up to thousands of dollars.

- Forgivable loans: You receive funds as a loan, but the debt is forgiven if you meet specific criteria, including living in the home for a set period (e.g., 10 years). If you sell or refinance early, you may have to repay a portion. You may also need to pay some of the money back if your income increases significantly before you sell.

- Grants: This is free money you never have to repay. As long as you meet the eligibility requirements, the funds are yours to keep. These are not common.

- Mortgage Credit Certificates (MCCs): An MCC provides an annual tax credit for a portion of the mortgage interest you pay, reducing your tax liability and lowering your effective housing cost.

Primary benefits of using a program

- Reducing out-of-pocket costs: DPA and closing cost assistance can dramatically cut the cash you need at closing, sometimes covering up to 100% of your required funds. Another great tool to cover closing costs is negotiating for the seller to pay some or all of those for you.

- Lowering monthly payments: A below-market interest rate can free up hundreds of dollars each month.

- Achieving homeownership faster: Instead of saving for years, these programs can help you buy a home within months.

- Building equity sooner: The sooner you start making mortgage payments, the sooner you build equity in your home. This can be a valuable financial asset.

- Overcoming high home prices: In the expensive Pacific Northwest market, these programs make homes that seemed out of reach suddenly attainable.

Common eligibility requirements

While rules vary, most first-time homebuyer programs in Oregon and Washington share common requirements:

- Income limits: These vary widely. In some cases, your household income must fall below a certain percentage of the area median income (AMI) for your county. But in other cases, the income limits are much higher. We even have programs with no income limits.

- Credit score minimums: Some programs require a score of at least 620, though some other programs may go as low as 580. Better scores often lead to better rates. We can help you find the right program for your situation, and often give you ideas on how to improve your credit.

- First-time homebuyer status: This usually means you haven’t owned a home in the past three years. However, most programs have exceptions for veterans and buyers in designated “targeted areas.” We also have programs with no first-time homebuyer requirement.

- Homebuyer education courses: Many DPA programs require you to complete a course covering the homebuying process, budgeting, and home maintenance. These are often available online. However, the education requirement is different for different programs. Let us help you make sure you take the correct course for your situation.

- Purchase price limits: Some programs set maximum home prices to ensure that they serve their intended market. These limits vary by county.

- Property type restrictions: Assistance is typically for a primary residence, such as a single-family home, condo, or townhouse. USDA loans are restricted to eligible rural areas.

Both Oregon and Washington are committed to helping their residents achieve homeownership. Next let’s explore the specifics of what each state offers.

First-Time Homebuyer Programs in Oregon

In Oregon, Oregon Housing and Community Services (OHCS) is one gateway to powerful homebuying assistance. OHCS works with approved lenders to pair a first mortgage (conventional, FHA, VA, or USDA) with a second mortgage for your down payment and closing costs.

Key first-time homebuyer programs in Oregon

The OHCS Flex Lending Program is a game-changer for those earning under program income limits. As of January 2026, the income limits are as high as $173,740 annually in some areas. It offers 4% to 5% of the first mortgage amount as a second loan for down payment and closing costs. For low-income borrowers (at or below 80% of area median income), a portion of this loan can be forgiven. As an additional benefit for low-income borrowers, there is no interest charged or monthly payment.

This program can cover up to 100% of the cash needed for the down payment. For more information, contact us, and we will help you understand how this program can benefit you. The Flex Lending umbrella includes FirstHome (for first-time buyers) and NextStep (for any homebuyer), making it a flexible tool for many situations.

Oregon eligibility: Income and purchase price limits

Eligibility for first-time homebuyer programs in Oregon and Washington depends on where you intend to purchase your home. Your household income is compared with the area median income (AMI) for your county.

Some programs offer exceptions for buyers in targeted areas (neighborhoods designated for economic revitalization) and for veterans, who may not need to meet the first-time homebuyer requirement.

Apply for Oregon Down Payment Assistance

Exploring Washington’s First-Time Homebuyer Programs

Across the river, Washington state offers its own robust resources through the Washington State Housing Finance Commission (WSHFC).

The WSHFC works with approved lenders like NW Capital Mortgage, A Division of American Pacific Mortgage, to deliver competitive first mortgages paired with down payment assistance. Many of Washington’s programs use second mortgages that don’t require monthly payments, freeing up your budget as a new homeowner.

Navigating first-time homebuyer programs in Washington

Washington’s first-time homebuyer landscape includes several key options:

- WSHFC Home Advantage program: This is the state’s flagship program, offering competitive rates on first mortgages that can be combined with various down payment assistance options. There is also a bond program for down payment assistance that you can apply for here.

- House Key Opportunity program: This program provides a second mortgage for down payment assistance that typically requires no monthly payments. The loan is usually due when you sell, refinance, or pay off your first mortgage.

- Down payment assistance second mortgage loans: These are the core of Washington’s strategy. Depending on the program, these loans can be deferred, interest-free, or even forgiven.

Special programs for veterans and specific professions

Washington provides extra support for those who serve our communities:

- Veterans Downpayment Assistance Loan Program: This WSHFC program offers dedicated support for eligible veterans, which pairs perfectly with the benefits of no-down-payment VA loans.

- Assistance for educators, first responders, and healthcare workers: WSHFC has historically offered improved DPA options for teachers, law enforcement, firefighters, and healthcare professionals.

- Energy Spark Home Loan: This program offers a lower interest rate if you buy an energy-efficient home, saving you money on both your mortgage and utility bills.

Washington eligibility and how to qualify

Washington’s programs have requirements to ensure that assistance is directed effectively:

- WSHFC income limits: Limits vary by county and program to reflect local costs of living and are designed for low- to moderate-income households. The core program, Home Advantage, has a statewide income limit of $215,000.

- Credit score requirements: A score of 620 or higher is typically required for most WSHFC programs, though some options may be more flexible (as low as 580).

- Homebuyer education requirement: A WSHFC-approved course is mandatory for most programs. These valuable courses cover the entire homebuying process and are available online or in person.

- Purchase price limits: Like income limits, maximum purchase price limits are in place for some programs. They vary by county and program. We can help you navigate this.

For more details, see our frequently asked questions on Washington down payment assistance.

Apply for Washington Down Payment Assistance

Your Roadmap to Securing Assistance

You’ve learned about the incredible first-time homebuyer programs Oregon and Washington offer. Now let’s walk through the steps to secure that assistance.

Step 1: Get pre-approved.

This is your most important step. Partner with a lender who specializes in state and local assistance programs (that’s us—many lenders are not approved or experienced with these options). A knowledgeable lender can tell you exactly how much you can afford and which specific programs you qualify for, giving you a pre-approval letter that makes your offer stand out to sellers.

Our team at NW Capital Mortgage specializes in these programs across Oregon and Washington. We’ll guide you through our straightforward loan process and help you get a quote custom to your situation.

Step 2: Complete homebuyer education.

Homebuyer education is mandatory for most DPA programs, and it’s genuinely valuable. These courses, available online and in person, cover the entire homebuying journey, from budgeting and credit management to navigating the closing process. You’ll learn how to avoid common mistakes and protect your investment.

Completing a certified course is your ticket to opening up many assistance programs. Organizations like the Portland Housing Center offer excellent homebuyer education options.

Step 3: Combine programs to maximize benefits.

Most DPA programs work with standard loan products like FHA loans, VA loans, or conventional loans. An FHA loan’s 3.5% down payment can be covered by DPA, while a VA loan’s closing costs can also be covered by assistance.

Your lender is essential here. They will help you determine which state and local programs can be combined for your maximum benefit. This is the expert guidance we provide at NW Capital Mortgage, ensuring that you get into your home with as little out-of-pocket cost as possible.

Frequently Asked Questions About First-Time Homebuyer Programs

Let’s tackle the most common questions about first-time homebuyer programs in Oregon and Washington.

How much down payment assistance can I get in the Pacific Northwest?

Down payment assistance amounts vary significantly based on the program and your location. The OHCS Flex Lending program provides 4% to 5% of your first mortgage amount.

In Washington, the House Key Opportunity Program and Home Advantage options offer down payment assistance loans that typically don’t require monthly payments, with amounts varying by income and county. Many buyers can cover up to 100% of the cash needed to close. Your specific assistance amount will depend on your income, location, credit score, and the purchase price of your home. That said, you can typically get up to 5% of the purchase price of the loan if needed.

Do I have to be a true “first-time” buyer to qualify?

The term is more flexible than you might think. Most programs use a three-year rule: If you haven’t owned a primary residence in the past three years, you’re considered a first-time buyer. So if you owned a home five years ago but have been renting since, you may qualify.

There are key exceptions:

- Veterans are often exempt from the first-time buyer requirement entirely.

- Buying in targeted areas (communities designated for revitalization) can also exempt you from this rule.

- Some programs, like Oregon’s NextStep loan, are available to any homebuyer, regardless of past ownership history, focusing instead on income eligibility.

- There is no first-time homebuyer requirement for many programs in Washington.

How much money do I need to contribute to my down payment?

The amount you need is likely less than you think. Many DPA programs require only a minimal personal contribution. For example, some programs ask for just $500 from your own funds, while others may require a contribution of at least 1% of the purchase price. These amounts are designed to be achievable.

Gift funds from family members are also often acceptable and can count toward your minimum contribution in some cases. Your lender can explain the documentation needed.

With the right combination of programs and seller-paid closing costs, it’s possible to cover 100% of your cash to close. Oregon’s OHCS Flex Lending program is designed to do just that, potentially allowing you to buy a home with very little of your own money.

Are there programs for buying a home in a rural area?

Yes! The USDA loan program is designed for properties in qualifying rural areas and is one of the most powerful tools available.

The biggest benefit is its 0% down payment requirement. This makes homeownership accessible for those who can afford a monthly payment but haven’t saved a large down payment.

The USDA’s definition of “rural” is broad, including many small towns and suburbs. You can easily check USDA property eligibility online. The program has income limits that vary by county and requires the property to be your primary residence.

We are experienced with USDA loans and can help determine if this powerful program is the right fit for you.

Take the Next Step Toward Homeownership

At NW Capital Mortgage, we’ve built our practice around helping people navigate these exclusive down payment assistance programs. We stay current on every program change to craft a strategy that maximizes every dollar of assistance you’re eligible for.

Whether you’re looking at a home in Portland, Seattle, or a rural property qualifying for a USDA loan, we can map out the smartest path forward. We’ll show you how to stack programs and pair DPA with the right loan type, whether it’s FHA, VA, conventional, or USDA.

You’ve done the research. Now it’s time to turn that knowledge into action. Our loan process is designed to be straightforward and transparent.

Start by exploring your options with us. Get a quote customized to your situation, or browse our loan program options. Your first home is waiting. Let’s make it happen together.

Resources:

OHCS Flex Lending program details

Check your USDA property eligibility

Washington State Housing Finance Commission